How Much To Itemize In 2024

How Much To Itemize In 2024. Charitable giving tax deduction limits are set by the irs as a percentage of your income. A deduction cuts the income you're taxed on, which can mean a lower bill.

A deduction cuts the income you’re taxed on, which can mean a lower bill. Isn’t one of the 30 most popular stocks among hedge funds at the end of.

How To Itemize Deductions On Your Taxes [Updated For 2024 Filing] | Financebuzz.

So your total mortgage interest for the year isn’t going to be $12,000;

People Should Understand Which Credits And Deductions They.

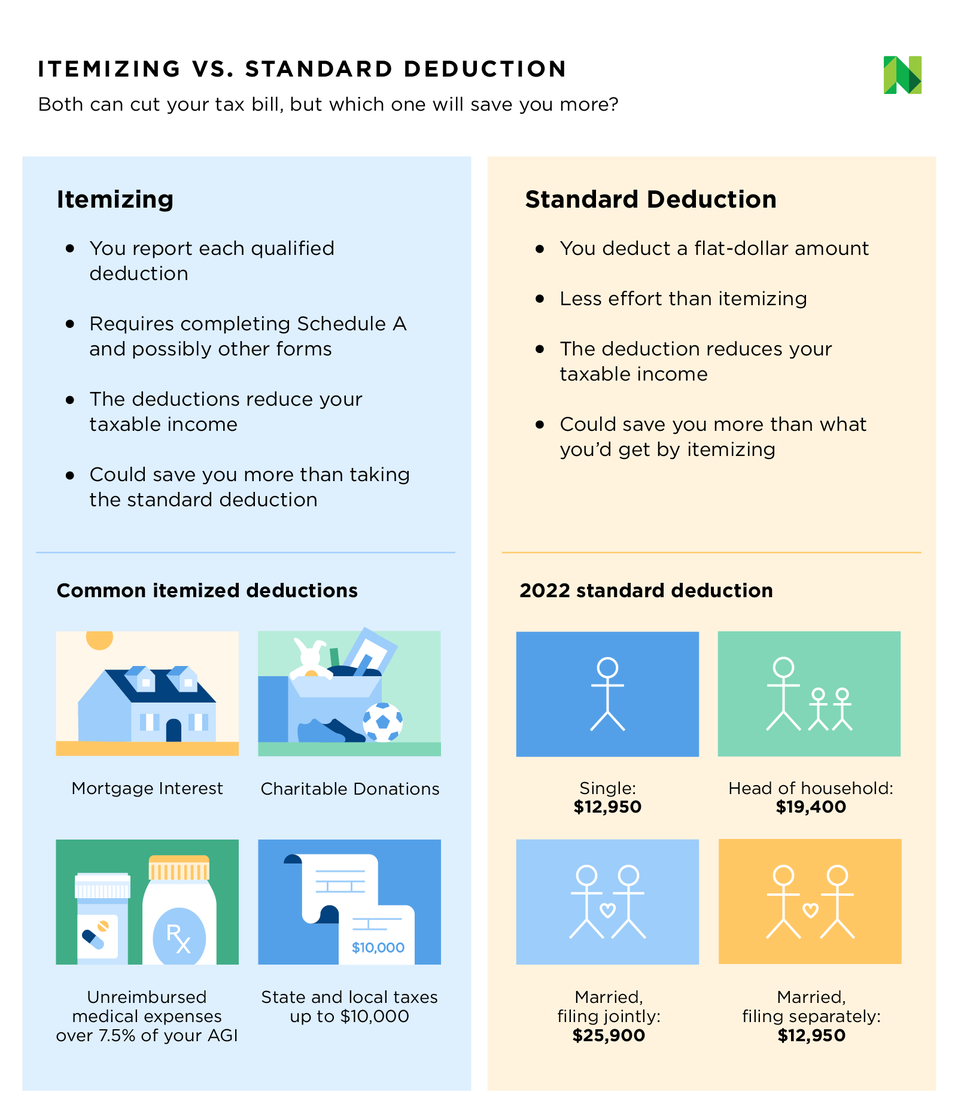

Itemizing can sometimes save you more money on your taxes.

Here's How To Do It.

Images References :

Source: veroniquewlilia.pages.dev

Source: veroniquewlilia.pages.dev

Minimum Earnings To File Taxes 2024 Ardyce Lindsay, How much to itemize in 2024. Itemizing can sometimes save you more money on your taxes.

Source: greenbayhotelstoday.com

Source: greenbayhotelstoday.com

Itemized Deductions Definition, Who Should Itemize NerdWallet (2023), When you file your tax return, you can either itemize—that is, deduct eligible expenses from your taxable income—or take a flat standard. Itemizing can sometimes save you more money on your taxes.

Source: www.pinterest.com

Source: www.pinterest.com

How Many Taxpayers Itemize? Finance, Tax guide, Deduction, In the later years of your mortgage, that same $1,500. How to itemize deductions on your taxes [updated for 2024 filing] | financebuzz.

Source: www.softwareadvice.co.uk

Source: www.softwareadvice.co.uk

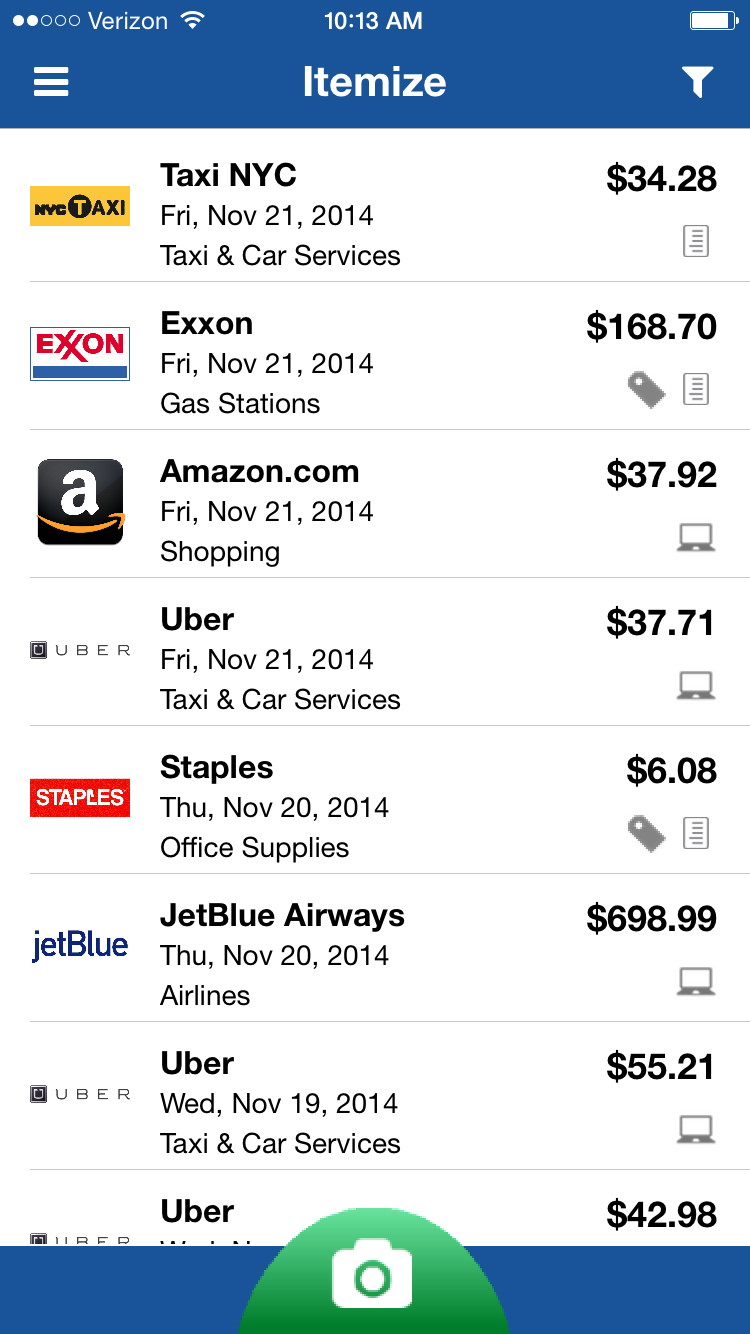

Itemize Software 2024 Reviews, Pricing & Demo, Itemizing (and thus, filing schedule a) will usually save you money if the sum of your itemized deductions is greater than the standard deduction. If you decide to itemize your deductions, the irs limits how much charitable deductions can lower your taxes.

Source: www.softwareadvice.co.uk

Source: www.softwareadvice.co.uk

Itemize Software 2024 Reviews, Pricing & Demo, The 2023 standard deduction is $13,850 for single. A deduction cuts the income you're taxed on, which can mean a lower bill.

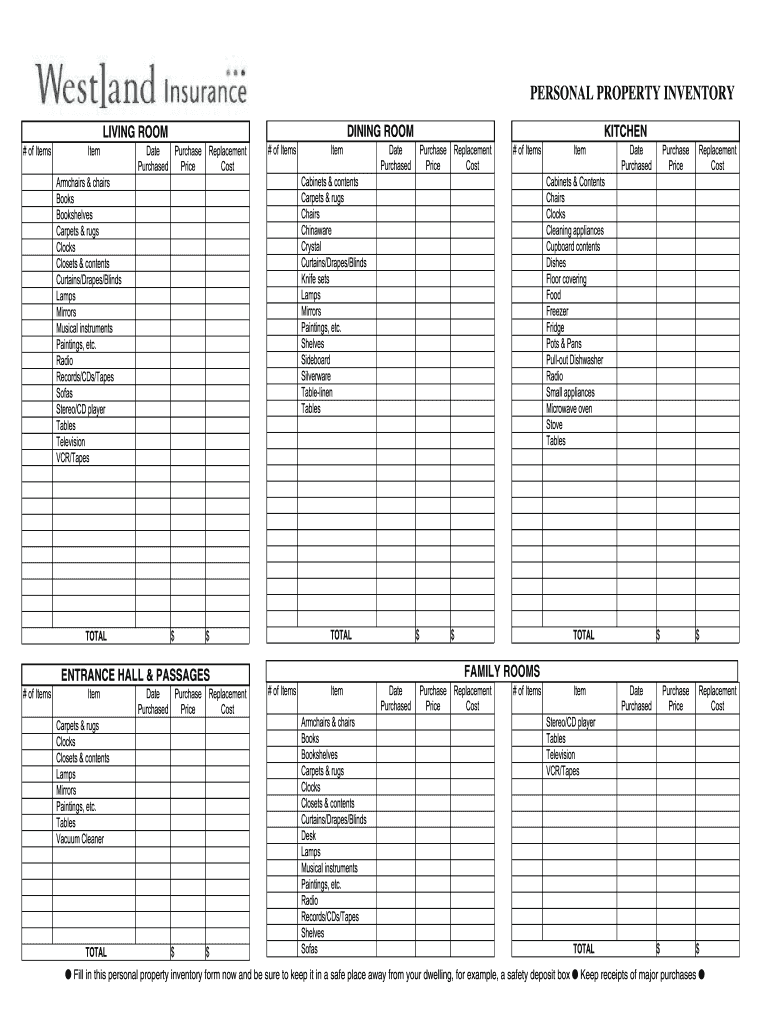

Source: www.dochub.com

Source: www.dochub.com

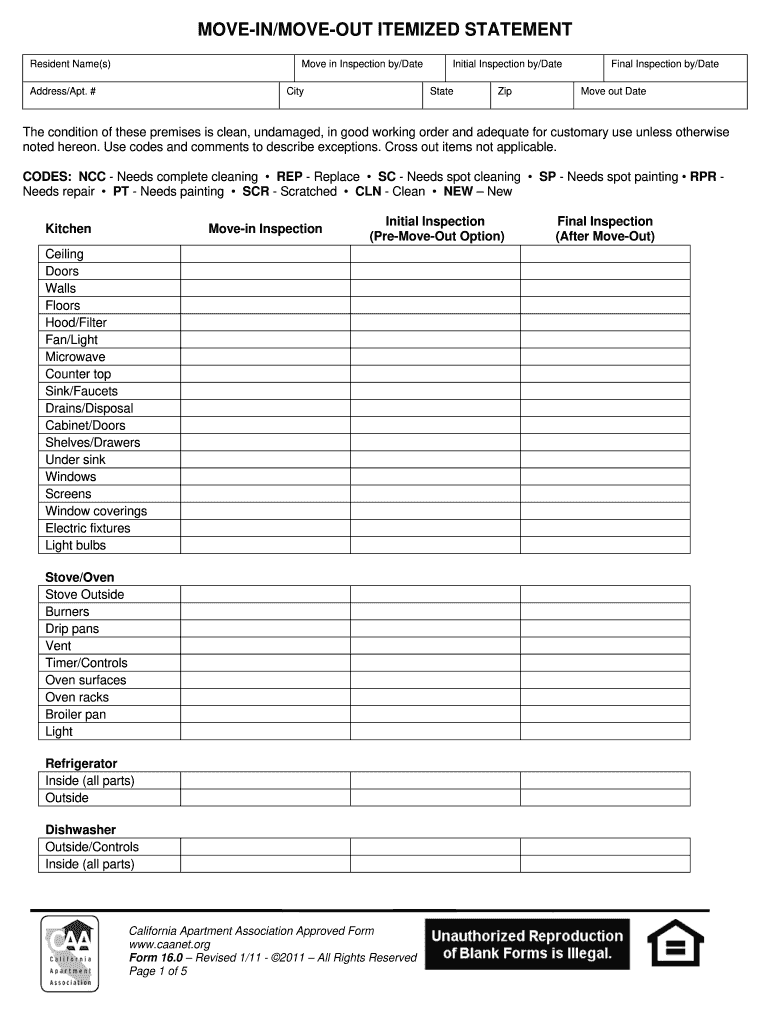

Itemization form Fill out & sign online DocHub, In 2023 (taxes filed in 2024) and 2024. Itemizing (and thus, filing schedule a) will usually save you money if the sum of your itemized deductions is greater than the standard deduction.

Source: estellawlilah.pages.dev

Source: estellawlilah.pages.dev

Itemized Deductions List 2024 Free Inez Reggie, Itemizing can sometimes save you more money on your taxes. Taxpayers can deduct charitable contributions for the 2023 and 2024 tax years if they itemize their tax deductions using schedule a of form 1040.

Source: mungfali.com

Source: mungfali.com

Itemized Budget Template, In 2023 (taxes filed in 2024) and 2024. As you can read above, the standard deduction for single taxpayers and married individuals filing separately has increased from $6,350 in 2017 to $14,600 in 2024.

Source: www.itemize.com

Source: www.itemize.com

Itemize Navigating 2024 Finance Leaders' Guide Using Lessons from 2023, As you can read above, the standard deduction for single taxpayers and married individuals filing separately has increased from $6,350 in 2017 to $14,600 in 2024. What are the charitable contribution limits?

Source: www.dochub.com

Source: www.dochub.com

Itemized list Fill out & sign online DocHub, What’s the threshold for itemizing medical expenses? Itemized deductions are specific expenses that taxpayers can subtract from their adjusted gross income to decrease their taxable income, potentially lowering their overall tax bill.

Taxpayers Can Deduct Charitable Contributions For The 2023 And 2024 Tax Years If They Itemize Their Tax Deductions Using Schedule A Of Form 1040.

When you file your tax return, you can either itemize—that is, deduct eligible expenses from your taxable income—or take a flat standard.

Head Of Household Can Now Claim A Standard Deduction.

For the tax year 2024, the standard deduction is $14,600 for single filers and $29,200 for married filing jointly.